Marathon County to consider deed restrictions

By Kevin O’Brien

With the goal of creating more affordable housing for workers, Marathon County supervisors have asked county staff to come up with restrictive covenants for tax-foreclosed properties sold by the county.

The idea comes from Bayfield County, which has implemented housing covenants to prioritize owner-occupied homes and longterm leases over the short-term rentals that have surged in touristy areas like Bayfield and Washburn.

Last month, members of the Extension, Education and Economic Development Committee (EEEDC) spoke with Kelly Westlund, the UW Extension housing educator for Bayfield County, about the various ways the county in northern Wisconsin is promoting housing development.

Supervisor Stacey Morache, chair of the EEEDC, started the conversation by reiterating objectives in Marathon County’s strategic plan, which calls for making land use decisions that promote economic growth and “ensure the future availability of a skilled, flexible workforce.”

More specifically, she wanted an update on a resolution passed by the board in December of 2023 that, among things, directed the county to “identify county-owned properties with significant potential for residential housing development and promote the development of housing on these high-potential properties.”

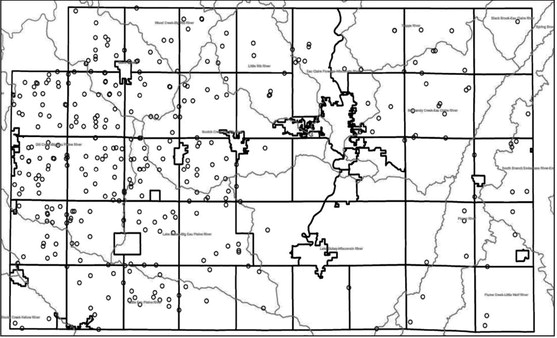

County administrator Lance Leonhard noted the county recently sold an unused parking lot in Wausau to the city’s housing authority and another lot to Habitat for Humanity. Looking ahead, he has asked Conservation, Planning and Zoning (CPZ) to come up with a comprehensive map of countyowned properties that are either in or next to a water and sewer district so that utilities can be easily accessed.

Leonhard said the county treasurer and clerk’s office are also working together to clear the backlog of properties with delinquent taxes, including those with vacant homes.

“We’ve really done a good job of making some progress,” he said. “We still have a long way to go. We sent out letters to over 1,000 parcels owners letting them know they had past-due taxes.”

Based on an amendment added to the 2025 budget, Leonhard said he is also writing a job description for a limited-term employee who can help the county sell off some of its surplus properties.

Westlund said Bayfield County’s deed covenants on tax-foreclosed properties include a prohibition on short-time rentals for 10 years after the sale, a requirement for occupancy within six months or construction of a new housing unit within two years.

“These can still be rentals, but they’re intended to be long-term rentals,” she said. “They’re not eligible for the permits you need to operate a short-term rental for at least 10 years.”

So far, Westlund said the covenants don’t seem to be discouraging people from buying tax-delinquent properties from the county. She said Bayfield County sold one vacant house for $30,000, and after the new owner spent a year fixing it up, they were able to sell it for $280,000.

When supervisor Ann Lemmer questioned whether the deed covenants might be too restrictive – especially the one requiring a house to be built within two years on vacant land – Westlund said Bayfield County has not sold any undeveloped properties yet, but she’s aware that some developers say it can take as much as six years to build.

“We’d have to cross that bridge when we come to it,” she said.

Supervisor Randy Fifrick said the taxdelinquent properties seized by the county are “low-hanging fruit” when it comes to promoting more housing, but he said it will be difficult to ensure that those new or refurbished homes are affordable because the owners are going to want the highest possible return on their investment.

“As much as we would all love to be generous with our money, if you build something like that, you’re going to look to extract the maximum amount of money,” he said. “That’s what your bank is going to want you to do; otherwise, they’re probably not going to give you a loan.”

Lance Leonhard