Dorchester board discusses financial options

Once the village board of Dorchester approved a street and lift project during its Jan. 4 meeting, the topic naturally turned to financing for its following monthly meeting on Wedensday, Feb. 2.

On hand to help the board know what options were available for financing was Ehlers representative Brian Reilly.

“Last I was here we talked in some very broad brush strokes about the projects you were contemplating,” Reilly said. “We’ve gotten that a little more refi ned since you’ve got actual bids and are proceeding.”

Reilly explained to the board that Ehlers compartmentalized financial plans to pay for the village’s upcoming construction projects, which includes reconstruction projects on South Third Street and Front Street.

Steen Construction will be working on the street projects, which will run the village $1,563,780. The village will also need to spend over $350,000 to replace the lift station located on Liberty Street and County Hwy. A.

Further expenses are a proposed upgrade to the village’s sewer treatment plant that will run in excess of $500,000.

“For your utility projects, you have permanent financing available through the state’s environmental improvement funds . . . you’ve largely gotten through the application process, you’ve been scored,” Reilly said. “So we’re confident those programs are available to you. It’s often the case you need interim finance. You’re taking on projects, you’re spending dollars, but that loan with the state isn’t going to close for some time, so you need a way to cash flow that. There’s a number of ways to do that.”

He said the village could use cash on hand, or could borrow the funds. The projects Dorchester approved last month were all higher than the initial estimates and the village does not have the cash flow on hand.

“What we’ve done is size and structured two interim financing issues related to water and sewer projects respectfully,” Reilly said. “You will also have obligations associated with the streets and stormwater portions of the street projects. We’ve taken out the water and sewer pieces, and then what’s left is really what I would call two pieces.”

Streets and storm water will need to be financed and the repayment source will be the village’s tax levy.

“That’s really the only available revenue source to repay the debts,” Reilly told the board. “You could pay cash if you wanted, but it takes a very long time to accumulate cash, especially in the environment of levy limits.”

Reilly listed four possible routes the village could take regarding financing their sewer, street and lift station projects.

One option suggested was a state trust fund loan. Reilly said a state trust fund loan could be structured into terms, with each structure having their own rates associated with them. Reilly said a twenty year loan with the state would come at a rate of four percent, which he admitted was “a little on the high side.”

Other financing options on the table was a general obligation promissory note that involved interim financing coming via a community development block grant (CDBG) that would be a million dollars.

“I can tag on for the one with the promissory note; that one’s fairly simple and straightforward. That’s the portion of the project that will get permanently funded essentially through grant funding,” Reilly said.

“Clearly you don’t have a million dollars right now. You will at some point, but it’s a reimbursable grant. It’s not uncommon to have to bridge that gap through financing. The objective here is to minimize to the greatest degree possible what your transactional costs are.”

Two other options brought forth were interim financing of sewer water projects through Clean Water Fund loans and grant funding and Safe Drinking Water loan and grant funding.

“The other two are what I would call “anticipation financing” and they’re interim in nature . . . those are not general obligations of the village.

“If for whatever reason you had to borrow all of it on a general obligation basis, you’d have very, very little capacity at that point.”

Reilly did not recommend the village pursue those sources of revenue, noting there was risk involved moving forward.

“Personally, I don’t think that’s a good approach. If something were to come up, and you needed access funding, you’d almost be prohibited from doing so.”

Reilly suggested the village pursue the state trust fund loan and the CDBG funding, though he told the board no matter what route the board went, Ehlers would be on hand to help guide the board through the process.

“We are indifferent as to the source of the capital, we just want to make sure we put a good plan together that puts you in a position to tackle that and get all the documents in order and make sure everything comes out.” The board felt most comfortable with the state trust fund loan and the CDBG funding as the village’s primary options, and made a motion approving Reilly to pursue those financial plans.

Other business

_ The board approved $3,000 for a DNR corrosion control report.

_ The board made a motion to approve the village’s garage sale from Thursday, June 9, to Saturday, June 11, 2022.

_ The board approved a long term sewere rate study by Ehlers Inc. for $13,000.

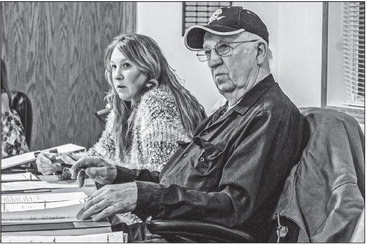

LISTEN TO THE MAN WITH THE PLAN -Dorchester village board members Julie Goldschmidt and Clarence Klimpke listen intently as Brian Reilly of the public financial advising firm Ehlers Inc., discusses possible financial options to pay for the village’s upcoming construction projects, among them a lift station and street and sewer upgrades.STAFF PHOTOS/ROSS PATTERMANN