completed in 2021 and 2022. ….

completed in 2021 and 2022.

Without TIF in place, the property taxes on these new developments would be shared with the Colby School District, Marathon County and Northcentral Technical College. A joint review board composed of representatives from those entities was also convened for the first time on Dec. 22.

Kristi Palmer, Marathon County’s finance director, said she was happy with MSA’s presentation, and praised the plan for being based on conservative estimates and realistic objectives.

The planning committee voted to recommend approval of a resolution by the city council to create TIF No. 3, a mixeduse district that will accommodate residential, commercial and possible industrial development. Ald. Steve Kolden abstained from voting due to his role as superintendent of the Colby School District, one of the entities that will be asked to give up tax revenue.

The council will vote on the resolution at its next meeting on Jan. 5.

According to a timeline provided by MSA, a second meeting of the joint review board will held sometime after Jan. 18, and the Wisconsin Department of Revenue (DOR) will be informed that Colby plans on creating a new TIF.

The ultimate goal is to submit information about the base property values, along with the TIF project plan, to the DOR by its annual Oct. 31 deadline. Once the new TIF is certified, the taxes on any new property value will be set aside for development costs for the next 20 years.

To pay for the Community Drive extension in 2021, the project plan calls for the city to borrow $985,000, at an interest rate of 3 percent and a 15-year payback period. A $1 million loan for North Second Street, with the same terms, is tentatively planned for 2022.

These annual debt payments will be covered by TIF revenues, which will also be available for other project costs that come up in the future.

Dave Rasmussen of MSA said the project plans are deliberately left vague, with “ballpark estimates” so the city has flexibility to pay for whatever kind of work may be needed down the road.

“What we try to do is consider all types of projects that might be implemented during the 20 years this TIF district is in existence,” he said. “We do that so, five years down the road, if something comes up, we don’t have to amend the project plan to include that.”

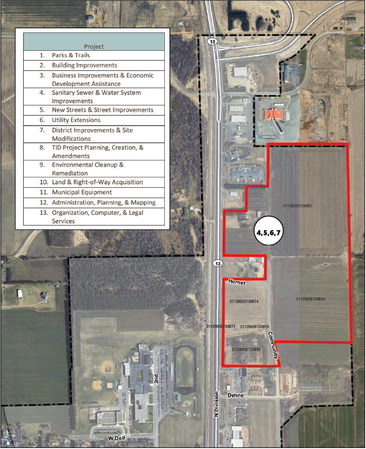

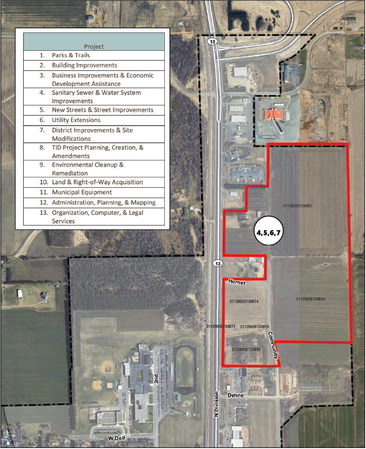

Rasmussen also noted that the boundaries of the TIF district can be amended up to four times to included additional parcels in the future. He said the six original parcels were chosen because they are currently open for growth.

“You want to include parcels that are going to develop,” he said. “If they’re already developed — if there’s no chance they’re going to expand — there’s no use having them in there.”

Colby has already borrowed $300,000 to purchase the 37-acre parcel of land at 1004 N. Division St. from Audrey Venzke, which cost the city $297,900. That loan will be paid back over five years using an increase in general property taxes.

The city is also paying MSA $13,000 to develop the TIF district plan and submit to the state for approval.

Colby’s TIF District No. 2 was officially closed earlier this year after a 20-year period of growth, which was also centered around the city’s northeast corner.