MASH Referendum: Financing of project would keep debt payments stable

Payments will wrap around existing debt to keep total levy stable over time

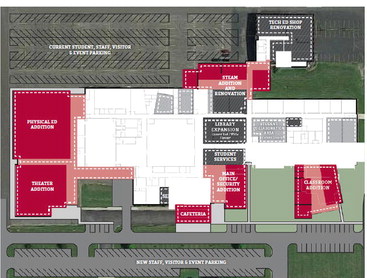

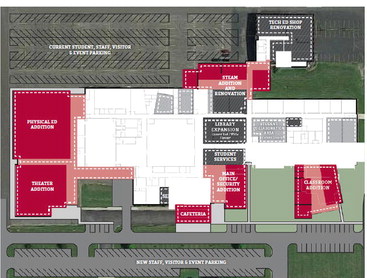

The Medford Area Public School District is banking on historically low interest rates as the board asks voters to approve a $39.9 million referendum project to renovate and expand the high school building.

The district has already revised down the projected debt service impact between last fall and now. Audra Brooks, the district’s finance director, says that estimated impact of $45 on a $100,000 is estimated high when compared to rates other districts are getting on the bond market.

She explained that the district’s financial advisors built the projection on interest rates being between 3.25% and 3.5%. Currently financial markets are seeing interest rates of 2.5% or less for similar borrowings.

Brooks said a lower rate would significantly impact the debt service payments by the district, which could potentially reduce the tax impact. She described the additional $45 on a $100,000 home as being the worst case scenario, noting that current interest rates are at the lowest point they have been in 30 years.

“It is not going to get lower than this,” she said, noting that while interest rates took a slight increase last spring when COVID-19 initially struck, they dropped again after that and have been relatively stable.

While the referendum will likely push up the debt service payments portion of the overall tax levy, the actual impact on the final tax bill won’t be determined until the school levy is set next fall. District debt service payments are just one factor that impacts the school property tax levy. With the state budget pending the district will not know until summer at the earliest if there will be any changes in state aids.

According to district administrator Pat Sullivan, currently school district property owners pay about $135 per $100,000 to pay off existing debt.

As he explains, “It is estimated that district taxpayers currently pay $135 per $100,000 of property value for referendum debt, which includes principal and interest. Your total school or “property tax” is higher than that, but keep in mind this referendum is about adding to the debt part. This amount will increase an estimated $45 next year if the referendum passes, which would bring it to $180 per $100,000 of property value. The impact is an increase of $45 over what you paid for debt this year. After this increase of $45, the amount will stay flat at $180 or go down for the next 20 years.”

Sullivan was addressing statements being shared in the community that the cost will skyrocket after the first couple years and that it goes up to $200 per $100,000 of value after that.

“That is simply not accurate,” Sullivan stated. “First, the document being shared is from the 2020 referendum and is outdated. This document has been updated with new assumptions including interest rates (lower) and property values (higher).”

Sullivan assures residents that the estimates they have are accurate. “We get this information from the managing director of public finance for Robert W. Baird. Baird has been working with our district for over 30 years and they have been in business doing the same for most of the school districts in Wisconsin for over 100 years,” he said.

“Above all, the district’s goal is for the taxpayers to get accurate information. If you see or hear some other figures, I would encourage you to ask them where their information is coming from,” Sullivan stated.

Low spending district

Medford school district has historically been a low spending district in comparison to the state average as reflected in the district’s property tax rate of $8.33 per $1,000 of equalized value. This is well below the state average of $9.22 per $1,000 of equalized value as well as being below nearby districts. For example, Gilman is currently at $10.66 per $1,000 of equalized value while Colby is at $9.11 per $1,000 of equalized value and Rhinelander is at $9.77 per $1,000 of equalized value.

Audra Brooks