Loyal board approves school banking program with Simplicity

It’s never too early to start saving for the future, and Loyal students will have the chance to put that principle into practice with the opening of a mobile credit union branch at school this year.

The Loyal School Board voted to approve the idea at its June 28 meeting, after hearing a presentation at its previous meeting from Jessica Zarnke, K-12 financial literacy teacher; and Ashley Landwehr, Simplicity Credit Union financial education coordinator.

“I really feel like now that we have a well-established (financial literacy) curriculum – it’s solid – we’re ready to keep moving. How can we enhance it? How can we make it better, right? We can do really good things, but we can always get better. We want to enhance what our students are doing, inside and outside of the classroom,” said Zarnke.

Simplicity Credit Union will operate a branch at the Loyal School District for elementary and middle school students. Students will have the opportunity to deposit money into an individual savings account. The tentative plan is to have the branch open one morning a week, during which students can deposit any money they bring to school. The money in turn will be deposited at the Simplicity branch in Marshfield.

The program will be at no cost to the school district and will encourage kids to set money aside for future goals.

“The sooner they start saving, it makes it part of their regular habits,” said Zarnke. “And I can attest, as an adult, it’s hard to save with so many awesome things out there, right? I joke a lot about the temptation of Amazon with my students. But the sooner we can build those muscles, so to speak, to save, and that habit, the better.”

According to the Consumer Financial Protection Bureau, children are developmentally capable of saving by age 5. A University of Kansas study also found that children who had a savings account were more likely to have one as an adult, and had more in savings than their peers without savings accounts. Children with savings were twice as likely to continue to have savings accounts and four times more likely to have invested in stocks. They also accumulated an average about $2,000, while those without a savings account early in life accumulated an average of $100. In informally surveying her students, Zarnke learned about half had a savings account already.

“For students that already have an account, that’s great — they can keep depositing and saving money. But for students that may have barriers, they don’t know exactly how to get a savings account, let’s get them connected so that we can set them up for more success financially as adults,” said Zarnke.

Simplicity already has a strong working relationship with the Loyal School District, having offered various youth and adult programs since the creation of the school district’s K-12 financial literacy program almost five years ago. Simplicity also has history working in area schools. The credit union established a mobile branch at Stevens Point Area Senior High in 2005. In 2007, the credit union started a branch at Nasonville Elementary. In 2010, Simplicity established a mobile branch at Marshfield High School. The two high school branches have a permanent structure within the school building, but that’s not necessary. At Nasonville, tables are temporarily set up in an open lobby area where students visit and do their banking.

The focus is not on the amount kids have in their account, but rather on promoting the importance of saving and teaching skills related to finance.

“At our Nasonville branch, I’ve had kids bring in a penny before because that’s what they had in their piggy bank. Or I’ve had kids say, ‘I dug all the change out of my mom’s purse this morning just to make a deposit.’ So they don’t have to be earning an allowance or anything like that,” said Landwehr.

“To open an account, it’s a minimum balance of $5. However, because we are doing a partnership, as long as they say they’re opening an account to participate in a school branch, we would give that first $5,” Landwehr also clarified.

The students will have to count their money and fill out a deposit slip. There will also be a team of students in charge of running the mobile branch. At Nasonville, sixth graders are the tellers and marketers for the branch. They apply, interview and train for their positions. Anyone who wants to participate gets to do so, but they interview for their specific position. At Loyal, Zarnke envisions the eighth-grade students being the tellers and marketers, and going through a similar interview process. This will help students get a jump start on job-ready skills.

Students will not be required to participate in the mobile branch, but it will simply offer another avenue for applying concepts learned in financial literacy class.

“We believe learning should be fun, so we make different games and have different prizes to encourage students, but ultimately it’s their own free will to come in, learn and see what it’s all about,” said Landwehr.

“One thing I want to be clear about is we do our best not to solicit our products or services. We’re there for the educational aspect. We have our logo there. They’re welcome to open accounts, but we never say that they have to.”

The school board members were very much in support of the idea.

“I think it’s a great idea,” said board president Dennis Roehl.

Board member Tom Odeen had one clarifying question. He asked if Zarnke could explain if she had approached Citizens State Bank about running a mobile branch and what their response was.

Zarnke said there had been some email communication back and forth. She had told Citizens State Bank she appreciated their partnership thus far and asked if they wanted to partner further. Before COVID, she had discussed the idea with the vice president, who has since retired, and that person had planned to think it over.

“They were open to it, but they didn’t have anything in play, so it’d be starting from the ground up. And then COVID happened and at this point, they are unaware of any programs like that offered through their Citizens State Bank, but are very open to continuing to partner with us in other capacities that they’re able to partner with us on, and at this point, it doesn’t sound like that’s one of them,” said Zarnke.

Satisfied that the most local option had at least been looked into, the board unanimously approved the mobile branch with Simplicity.

The tentative timeline is as follows: Zarnke and Landwehr will iron out some of the logistics details this month, and promote the mobile branch at the school’s open house and on social media next month. In September, they will interview, hire and train the eighth-grade volunteers to run the mobile branch, with a grand opening tentatively planned for October.

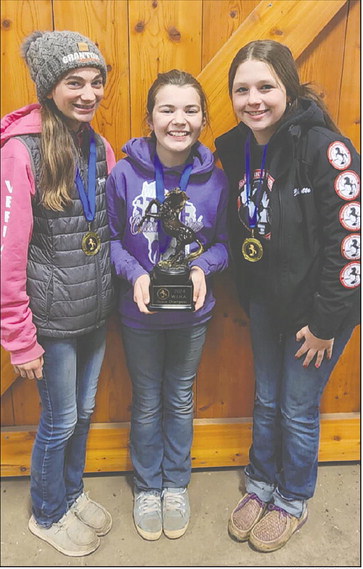

Financial literacy at Loyal The mobile branch program will add on to the school district’s existing financial literacy program, which is funded through an endowment from Dr. Eldon Hill and managed by the Eau Claire Community Foundation. The K-12 program launched in the fall of 2018 and Zarnke began teaching at Loyal in January 2019. Program highlights have included K-12 financial literacy classes; adult financial literacy evening programming and family nights; state InvestWrite Essay winners in 2021, 2022 and 2023; and state Stock Market Game Elementary Division winners in 2023.

“I’m really proud of what our students are doing and what our program is offering to our students,” said Zarnke.

The financial literacy program has partnered with several local businesses and organizations to enhance the opportunities available to students. Simplicity Credit Union has provided youth and adult programming, youth presentations and mock interviews; Citizens State Bank has provided youth programming and mock interviews; Thrivent Financial has provided adult programming; Hadler Financial Services has provided youth presentations; and Forward Bank has offered youth programming.