County tax rate to drop under 2022 budget

Taylor County is banking that local sales tax collections remain strong as the preliminary county budget heads to full board for action later this month.

The preliminary county budget uses $1.4 million of local sales tax revenue in addition to dipping into county reserves for about $400,000 to balance the budget for the coming year.

The preliminary budget estimates total spending for 2022 to be at $27,771,523 which is projected to be down 1.57% from the 2021 budget. The county receives revenues from multiple sources including state aids, federal projects, local fees and forest logging revenue. The amount left over after all those other revenue sources are accounted for is the local tax levy which is paid by county property owners.

All counties in the state are under an ongoing levy freeze which limits the county from raising the levy above the growth rate of the community. The primary exception to this is to cover debt service payments.

County taxpayers will pay slightly less in the county portion of their property tax bills under the spending plan that will advance to the full county board on October 27.

The budget committee worked to close a $600,000 gap between the preliminary budgets submitted by the county departments and the goal for the final levy. Committee members are recommending a budget with a tax levy of $12,376,998. While the levy is slightly higher than last year’s the increase in the county’s overall valuation is bringing the tax rate lower.

Last year’s tax was $8.18 per $1,000 of equalized value. The rate under the proposed budget for next year will be $8.11 per $1,000 of equalized value, a savings of $7 on a home valued at $100,000.

The equalized value for all Taylor County property is set by the department of revenue at $1,526,326,100 an increase of about $23.8 million, or 1.6% from the prior year.

County finance director Larry Brandl reviewed the proposed budget with committee members noting that in addition to increasing the amount of county sales tax to go toward budget relief, they are increasing the amount of forest crop revenue that will apply to the levy by $150,000. Brandl noted the forest administrator was comfortable with the increase as being a conservative figure.

According to Brandl, in addition to those changes, he recommended applying some of the borrowing done last year to cover road projects in the highway department which would free up some space in the budget. The remainder, he said would come out of fund balance. He noted that last year, the county applied $300,000 from fund balance, but he is anticipating that based on how the current budget year is shaping up, they will likely not need to tap into that amount.

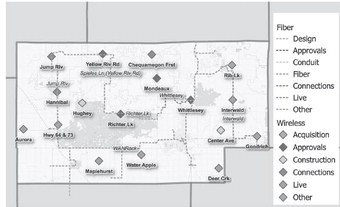

“I think we will be close to being in the black without needing that $300,000,” he said. Brandl noted the county is hoping to get a revenue stream from the lease of the broadband network in the next two years which will help the levy in the future.

The big question for the county budget is what will happen with the wage study currently being done by Carlson Dettmering. The study was commissioned after concerns from human resources director Marie Koerner that the county was not competitive in attracting employees.

The budget as presented does not include any wage increases for employees other than what is built into the current pay matrix. With the consumer price index at about 2%, committee members noted they would need to do something, however they were unwilling to set an increase at this time with the result of the study not being known until at least December.

Some budget committee members suggested the wage scale changes should go into effect as part of the 2023 budget rather than implementing them in the 2022 budget.

Koerner disagreed. “Now is when we have the problem, not two years from now,” she said.

“We will have to raise salaries,” said committee chairman Chuck Zenner, noting that he felt they should go in the budget this year. A 1% increase in overall county employee wages equates to between $60,000 and $70,000 in additional cost.

“There will need to be an upward adjustment of salaries. I don’t know how much,” said committee member Scott Mildbrand.

Brandl suggested the county set aside the money from the sale of a property on Hwy 102 that had been purchased by the county a few years ago to house a recently released inmate and was being rented by the state. The individual has since relocated to a different state and the house was sold for more than the county’s original purchase price. Brandl said that money could be used to help implement the rate study in the 2022 budget.

Board member Lester Lewis reminded committee members that even if the money is not earmarked in the budget and goes into the general fund, the board can always vote to amend the budget and bring it back.

“The budget is a living document that will change over the year,” Lewis said, noting that it represents the best guess for the county board.

“You are making the best guess you can,” he said.

Committee member Ray Soper noted the amount in the budget for wage adjustments would give the county enough for roughly 3% across the board. Lewis cautioned against setting a specific amount for wage increases because depending on the study any actual changes could be different for different people.

In the end, the committee voted to send the budget to the full county board with funds set aside for potential wage increases but not committed for that purpose. Committee member Tim Hansen voted against the motion noting that for employee morale, they should have built in a 1% increase. He was concerned that employees would see the budget as giving them no increases. He also noted that the county may not do anything with the wage study depending on its results.