Tax rate jumps in Medford

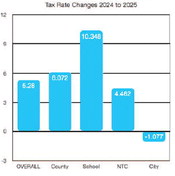

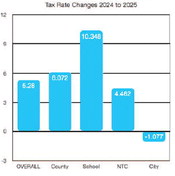

City of Medford taxpayers will see about a 5.28% increase in their property tax bills later this month.

The increase was driven by a recently approved school referendum and an increase in the county tax levy. By comparison, the city portion of the total tax bill dropped this year by more than a percentage point.

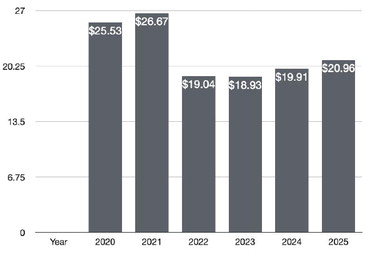

At Tuesday's Medford City Council meeting, council members formally set the aggregate net tax rate at about $20.97 per $1,000 of assessed value, this is up from last year's rate of $19.91 per $1,000 of assessed value. This amount reflects the substation due to the state tax credit.

What the change from last year means is that the owner of a home valued at $150,000 will pay about $158 more in local property taxes than they did in 2024.

See CITY on page 4 By far the biggest factor for the increase was a 10.34% increase in the school portion of the tax rate. The county portion of the tax rate jumped 6.07%. The technical college district taxes also saw an increase of 4.46% compared to last year. This city of Medford portion of the tax rate dropped wth a 1.07% decrease from last year.

Overall, the aggregate city of Medford tax rate is below the six-year average since 2020 and well below the high of $26.67 in 2021. Individual tax bills can vary based on things like special assessments for road projects or unpaid utility fees.

When contacted after the meeting, school district finance director Audra Brooks, confirmed the school tax increase this year includes the projected referendum debt service. She said the school levy is projected to remain about same next year.

“We will begin to see aid from the debt payments in the 2026-2027 fiscal year. After that, the mill rate for the debt portion is projected to go down considering the aid we receive,” Brooks said.

When municipalities set the final tax rates they do so based on assessed values, while schools and the county make projections based on equalized or “fair market values.” The city of Medford saw a 5.32% increase in the value of property in the city. For overlying taxing districts such as the school and county, the state law set the amount of the total levy assigned to each community based on their overall portion of the equalized value of the whole district. As a result an increase in property values in one municipality versus others could result in tax shifts in any given tax year.

Solar project

The city of Medford is looking to add solar power. The city electric utility is part of Great Lakes Utilities (GLU). The consortium allows the member municipalities to purchase power at a better rate than they could do so by themselves.

GLU is hoping to bring this advantage of bidding a larger project to solar. Under the plan, GLU would bid out the project and each member municipality would have a solar field on their systems.

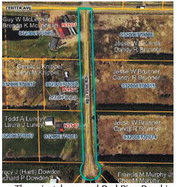

City coordinator Joe Harris said the city would look at putting it next to the west substation which is located south of Hwy 64 near the high school complex. The city already owns about five acres around the substation so no additional land purchase would be needed for it. Harris estimated the solar field would generate about a megawatt of power. By comparison, the city total usage is between 4 and 5 megawatts of electricity.

Harris explained that there federal mandates for having renewable energy developments as well as large federal subsidies for these types of projects. Alderman Mike Bub asked if GLU had looked at wind versus solar.

Harris said GLU picked going with solar because wind only has certain pockets around the state where it is feasible.

“The sun shines in all communities,” Harris said, noting it is something every GLU member would benefit from doing.

Harris said he saw it as being an additional backup for power if there was a major regional outage since the power generated would feed directly into the city system. He noted that the hospital is on the circuit served by the west substation which means that if there was a catastrophic outage, the solar field would be able to provide power needs for the hospital during the day.

“This is just something we would have in our backyard,” Harris said. From a broader prospective, Harris said the solar field could save city rate payers by reducing the amount of expensive peak power that would need to be purchased. He explained that the peak power usage is in the city is during the day between 1:15 and 1:30 p.m. This would match the time of peak power output of the solar field and help reduce the amount of power the city utility would need to purchase during that time to meet demands.

Council member Laura Holmes asked if this would mean that potentially the rates would go down.

“A better way to put it is that they wouldn’t go up as much,” Bub said Council member Ken Coyer asked about any concern with disposing of the panels at the end of their usable life. Harris said some of those with existing fields have been refurbishing them, but other dispose of them and get replacement panels as needed to be mounted on the same posts.