Marathon Co. adopts 2025 budget with no tax increase

By Kevin O’Brien

Marathon County supervisors thwarted a $1.7 million property tax increase on Tuesday with a pair of budget amendments that directed county officials to dip into fund reserves and increase other revenues to help pay down debt in 2025.

Over the course of a nearly three-hour long meeting, the 37 board members in attendance (one remotely) adopted a total of five amendments that had been drafted by various supervisors since the county’s first budget hearing on Nov. 1. Three other amendments, including one that would have eliminated all of the revenue from the county’s wheel tax, were voted down.

In the end, the board voted unanimously to adopt a $198 million budget with a total property tax levy of just under $58 million, which is about 3.3 percent less than what was originally included in the budget proposed by county administrator Lance Leonhard in October. As a result of the amendments adopted Tuesday, the 2025 tax levy will remain essentially the same as this year.

The entire reduction in taxes will come from the debt service portion of the levy, which dropped from the original proposal of about $4.2 million down to about $2.3 million. This will allow the county to increase its operational levy by the percent of net new construction within the county, which was 1.78 percent this year, while still keeping the overall levy flat.

In the effort to stop taxes from going up next year, the biggest single push came from an amendment offered by supervisor Brandon Jensen of Merrill, which directed the county to take $1 million out of the Highway Reserve Fund and another $647,209 out of general fund reserves to offset a $1.6 million reduction in tax revenue.

Jensen said his goal with the amendment was to eliminate a majority of the tax hike originally planned for next year, with the longterm goal of reviewing the county’s expenses for ways to save money. He said this

See COUNTY BUDGET/ Page 16 County budget

Continued from page 1

was based on feedback from constituents.

“The message has been to stop raising taxes,” he said. “Marathon County residents have implored and entrusted their county board representatives to be good stewards of the programs and services funded by their taxes.”

County administration and employees “have carried out their duties in a cost-effective manner,” he said, commending them for making the best use of state and federal dollars, but he also said that taxpayers are hurting financially due to inflation.

“It wouldn’t be right to sit at this table and assume that we know how to spend their money better than our residents and requiring them to make other sacrifices while their taxes continue to increase,” he said.

Jensen’s amendment faced some pushback from supervisors who were concerned about spending down the county’s reserve funds, many of which are designated for specific purposes or needed when unexpected expenses arise.

Supervisor John Robinson said the large balances in some of the county’s reserve funds can be misleading, since a lot of that money is supposed to be set aside for various reasons. Looking at the general fund balance of $47.6 million, for example, he pointed out that the actual unassigned amount is $6.6 million, according to a memo from finance director Sam Fenzke provided to supervisors.

Robinson also noted that Marathon County has lower fund balances than many other counties, and said that reducing those balances could negatively affect the county’s bond rating, which would lead to less favorable interest rates when borrowing money.

“While I’m concerned about property taxes,” he said, referring to his own property value assessment jumping from $265,000 to $400,000, “we still need to fund services.”

Ultimately, the board voted 22-15 to adopt Jensen’s amendment, which eradicated nearly all of the proposed tax increase.

A second amendment, authored by supervisor Gayle Marshall, brought the increase in taxes down to zero by budgeting an additional $250,000 for interest and penalties collected on past-due taxes. Given the county’s recent push to pursue payments from taxdelinquent property owners, Marshall said she spoke to county treasurer Connie Beyersdorf, who agreed that the county can expect an increase in collections next year.

Marshall’s amendment was far less contentious than other ones discussed on Tuesday and it passed 33-4.

OWI court funds moved

After the board succeeded in zeroing out the tax increase for next year, supervisors moved on to an amendment from supervisor Tim Sondelski that would have originally eliminated the $107,528 that goes to the county’s OWI court, which provides a treatment alternative for repeat drunk drivers.

Right now, the OWI court only has two participants, following a change in state law that made fifth and sixth OWI offenses a felony with mandatory jail sentences.

“This is not a sustainable court,” Sondelski said.

Judge Suzanne O’Neill, who oversees the OWI and drug court programs, said all six of the county’s judges signed on to a letter supporting continued funding for both courts, which allow defendants to seek drug and alcohol counseling as an alternative to jail.

“As our letter outlines, we have witnessed participants change their lives to become valued members of our community,” she said during a public hearing on Monday.

Given the mandatory jail sentences for fifth and sixth OWI offenses, Judge O’Neill said the county’s Criminal Justice Coordinating Council is working on a plan to revamp the program. One idea that has come forward is to split the drug court program in two, offering one for male defendants and another for female defendants.

Judge O’Neill said the available evidence suggests that separating treatment court programs by gender is more effective because it allows participants to share intimate details of their lives in a more comfortable setting.

Following this suggestion, supervisor Stacey Morache offered an amendment to the amendment that will transfer $107,528 from the OWI court to the drug court program so that it can be used to pay for a new gender-separated program. Supervisor Matt Bootz, a member of the CJCC, noted that the two people currently in the OWI court will still be allowed to complete the program.

Morache’s amendment passed on a 37-0 vote, and the overall amendment passed with just one no vote.

Failed amendments

Three amendments proposed at Tuesday’s meeting generated a fair amount of discussion but were ultimately voted down.

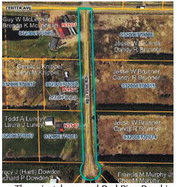

The most hotly debated amendment, from supervisor Deb Hoppa, would have eliminated nearly $3 million in revenue generated by the county’s $25 per vehicle registration fee (wheel tax) but it would not have eliminated the fee itself. (See separate story for more details).

Another amendment by Supervisor Marshall would have cut funding to the aquatic therapy pool run by North Central Health Care by $150,000 next year, reducing the county’s subsidy in half.

Marshall said she initially authored the amendment after seeing that the aquatic pool was expected to generate $192,000 in profit next year, but that was before she learned that factoring in depreciation (money set aside for future repairs) would actually bring the pool’s fund balance below zero.

The motion to adopt the amendment failed on a vote of 5-32.

Lastly, an amendment by supervisor Chantelle Foote to cut the tax levy by an additional $1 million using reserves was resoundingly defeated, with Supervisor Sondelski being the only to vote for it.

Supervisor Scott Poole said he’s “all for cutting taxes,” but with the passage of Jensen’s amendment, he thought that cutting the levy by $1 million was “a bridge too far.”