Cadott School District Annual Meeting; District voters see finances, set school levy

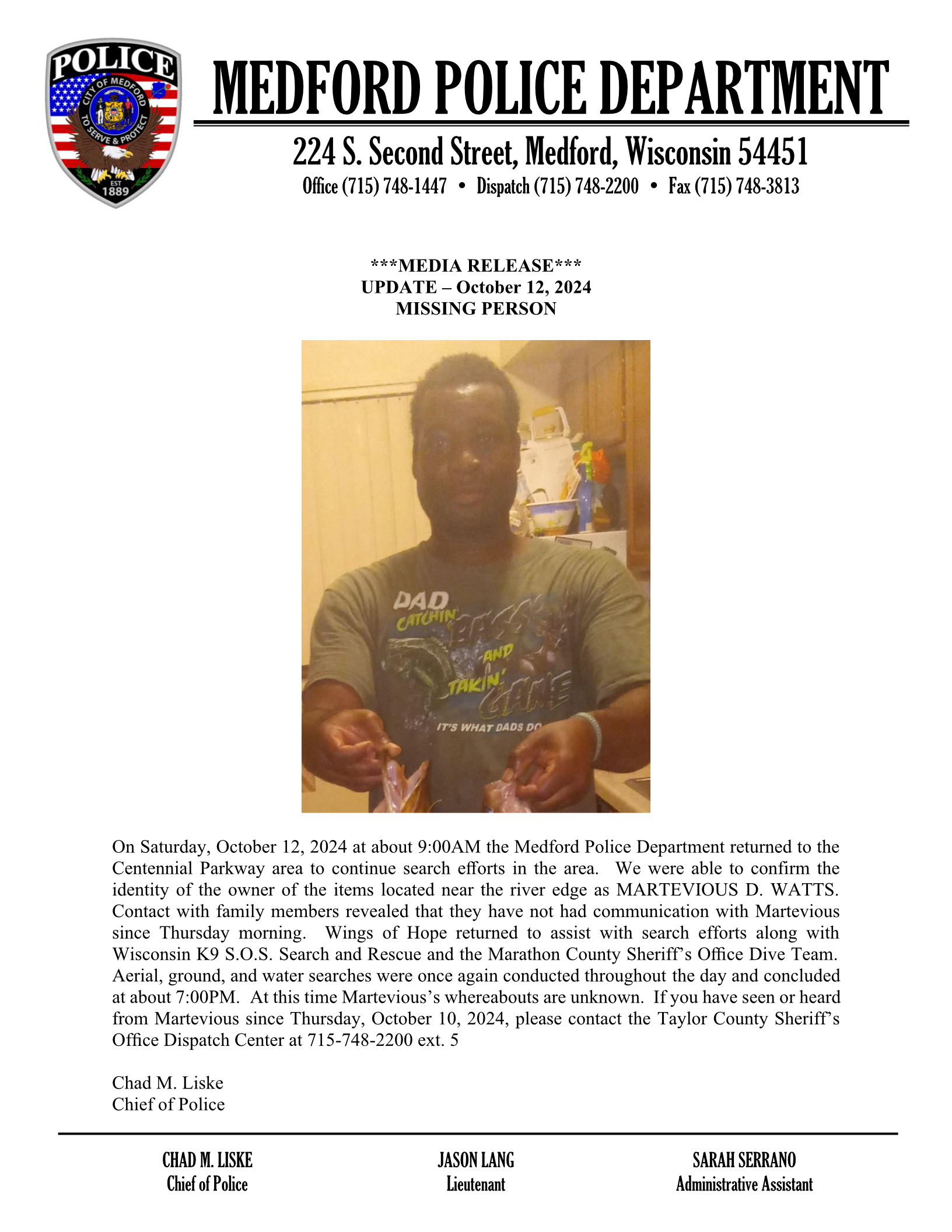

The Cadott School District annual meeting took place Oct. 24, where yearly issues were voted on by district electors. The school tax levy remained steady at $4,694,418, with the mill rate seeing a decrease to $9.01. Photo by Julia Wolf

By Julia Wolf

District electors made their voices heard, during the Cadott School District annual meeting, Oct. 24, where yearly issues like the school tax levy, lunch prices and Board of Education salaries, are set with a vote.

The annual meeting began with a budget summary of the proposed budget for the 2022-23 school year, showing how the money is divided between the different funds.

Sue Shakal, director of finance and human resources, says a balanced budget is projected in the general fund (Fund 10), with $13,985,659, for the revenues and expenditures for the year, leaving a starting and ending fund balance of $1,897,459.16.

Following the brief overview of the budget, there was time for questions.

Board member Brad Sonnentag asked if they plan to add to the General Fund balance this year. Shakal says there was not enough room in the budget to plan too much to be added, but is hoping a small amount can be added to the fund balance at the end of the year.

Superintendent Jenny Starck explained they try to add to that fund balance slowly over time.

“We do not get state aid on that money,” said Starck. “So, we don’t want to dump a large amount at once, because we lose out on that state aid.”

Starck says the idea is to build the fund balance up enough that they do not need to do short-term borrowing.

Community member Jon Wanish also asked if the district is fully responsible for upkeep to the bus garage, or if Kobussen shares in that cost, since they are leasing the building.

“We are generally responsible for, what I would call, upkeep/ repairs,” said Starck. “So, if something wears out. If something gets damaged or something else happens, then they would share in that responsibility or be responsible for it.”

In the superintendent’s report, Starck started with a review of how revenue limits work in school districts.

“The revenue limit is the most you can really spend on your education for students,” said Starck.

The enrollment count, the students who live in the district, is multiplied by the per pupil revenue limit, which produces the revenue limit for the district.

Increases to state aid helps taxpayers, because it covers a larger portion of the revenue limit, with local taxpayers covering the rest.

“But the limit is still the limit,” said Starck, adding more state aid does not mean the district has more money they can spend.

When going through the revenue limit worksheet, Starck also talked about special education funding. She says the district transfers about $1.2 million each year, to cover special education costs. Starck says more special education reimbursement would help all students, because the district would not need to transfer as much.

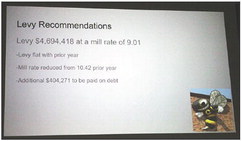

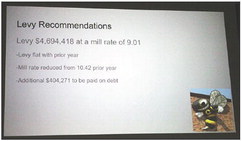

The proposed mill rate was also discussed, with data showing trends from the past few years. The mill rate is the tax rate, per thousand dollars of property tax value.

The proposed mill rate for the 2022-23 school year, was $9.01, down from $10.42 the previous year. Starck cautioned that taxpayers may not see their taxes go down by that amount, since property values increased.

The proposed levy amount was $4,694,418. “That’s flat with last year,” said Starck. That would also give the district an additional $404,271, to be used for debt payments.

District electors voted to authorize the school tax levy of $4,694,418, with $3,464,823 of that for the general fund, $1,221,306 for debt service and $8,290 for the community service fund.

A special school board meeting following the annual meeting, approved the same.

Next up, were school board member salaries. The current salary is $1,650 for the president, $1,320 for the clerk and $1,210 for members. Shakal says the last time the salaries were raised, was in 2016.

Board president Cory LaNou said he thinks it seems low, compared to municipality salaries. He said it is not an argument for him personally, as he is not serving on the school board for the money, but said more districts are upping the amounts to reward those getting the work done.

LaNou also said he likes the method some surrounding districts have, where all board members, regardless of position on the board, get the same flat rate for each meeting they attend.

“You’re all putting a lot of the same effort in,” said LaNou. Electors voted to keep the salaries at the current rate, with three people opposed.

A slight increase to lunch prices are scheduled to go into effect for the 2023-24 school year. The prices approved during the meeting were $2.35 for 4K-sixth grade; $2.50 for seventh-12th grade; and $4.65 for adults.

LaNou shared some of the accomplishments in the past year, during the president’s report. As far as technology goes, LaNou says the district is looking at potentially expanding the 1:1 program to sixth grade.

“That’s going to allow them to take home their devices,” said LaNou.

He says they are also looking at revamping the life expectancy of the Chromebooks in the 1:1 program, from six years, to three to four years.

As a notice to the public, the 2023 annual meeting will take place Monday, Oct. 23.